First off it was a great conference with a lot of phenomenally smart people and talent.

It was good meeting internet friends and others in person. One thing is for sure Lawrence Lepard is one of the more genuine people you will meet and Greg Foss will energetically engage and connect with anyone willing. Both are great guys.

The other high-level point is the astounding speed with which the average bitcoiner has come to understand at least the basics of true economics. Not the theoretical backward kind taught in most college courses, but the real-world stuff that happens daily and is backed by data… the unmassaged kind at least.

I could not agree more with a quote from James Lavish, also another good guy to meet, who’s working with Greg on some cool stuff as well.

In regards to the conference, there were many great sessions but a couple that really stood out.

Jack Mallers → Strike / Shopify / NCR Partnership

Jack Mallers’ announcement was a true paradigm shift. The world will become a different place starting 4/9/2022.

Why? Because a full frontal assault on the point of sale (POS) machine just started. Meaning, bye-bye 3% credit card transaction fees and a lot of lost revenue to the traditional monetary middle men and banks. Yes. There will be a fight and this will absolutely take time, lots of it. At the same time, I do believe history books will refer back to this date and presentation in much the same way that Jack referred (incessantly) back to the 1949 credit card network. Jack’s update very much matches my own view, so I’m admittedly biased.

The fight to maintain the old way of doing things will be a bloody one.

It’s Maller’s / Strike’s ambition to replace the POS globally with a set of API (Application Programming Interface) that allow for instant settlement of any currency offered by almost all the major retailers. They’re already working on Shopify and many other large brands. Interoperability is coming to money via the Bitcoin network.

This is money’s Facebook, Amazon, Uber, Google Drive moment…

and the greatest products are still in the making. Who knows what the names of the next wave of companies will be. Sure, there will be booms, busts, and headaches along the way, but it will not shock me if this announcement is the beginning of the next wave of technology innovation that drives economies in the coming decades. That’s how big a deal it was IMO (our post announcement conference podcast thoughts).

Peter Thiel → Value vs. Velocity

The opener was amazing. It was Peter giving a talk in the late 90s or early 2000s, where he correctly predicted how we would arrive at where we are today. I hope he’s around in 20 years to look back on his Bitcoin 2022 speech and project forward yet again.

While many more people today have a better understanding of what money is, there is still a good bit of confusion around money as value, money velocity, and money as technology. You can connect the dots between what Thiel and Mallers said to arrive at the technological piece.

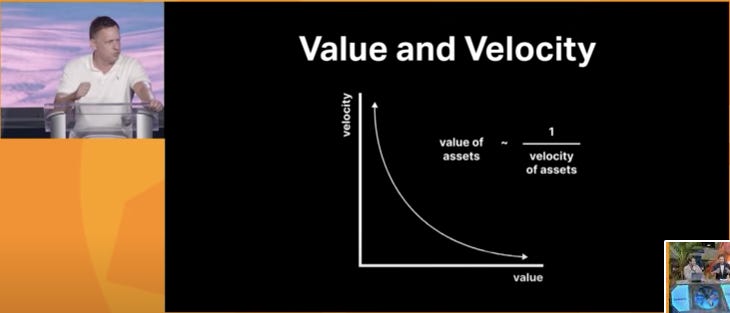

Velocity is not money, it’s a function of money. More velocity = less value in the underlying asset, as it relates to “money”. This is where the Ethereum, Ripple, et el crowd gets it wrong. They’re laser focused on TPS (transactions per second) which is not a function of money as a store of value. Store of Value is the number one problem the world faces today because it’s missing.

Assets are not valuable because they have a high level of velocity. It’s actually the opposite.

Assets derive value from having lower velocity coupled with scarcity to provide a higher means for storing of value. As Parker Lewis says, “the value of any good naturally trends toward its cost to produce”. There aren’t a lot of costs associated with hitting CTRL+P which is why, over the life of the dollar, its value has declined to zero.

Granted, there does have to be velocity or we’re not talking about an asset. Something that doesn’t move is just as worthless as something that moves way too much which is a good reason for Bitcoin to continue to innovate. That’s the torch that guys like Jeremy Rubin are pushing for.

That’s velocity in a nutshell.

Finding the right balance makes all the difference, in value, in the world ;) If anything, we should all be acutely aware of this just from watching the supply growth and velocity of the dollar network the last 5 years. CTRL+P… CTRL+P… CTRL+P.

While admittedly Bitcoin has suffered during this recent bout of inflation it hasn’t lost its luster. Most other sound or hard assets have done very well, but at differing times.

As Thiel shows, Bitcoin was the signal, not the noise. Unfortunately, the average person gets caught in the moment and pays little attention to the past, present, and future.

So, while Bitcoin was rocketing from September 2020 to May 2021 most were listening to the FED sing the “inflation is transitory” song.

This move was the signal that inflation was coming. If you were calculating the costs of goods in your life, then you were aware inflation was here. Now that it’s obvious, and Bitcoin has taken a breather. So, naturally you’re starting to hear rumblings that Bitcoin’s “not working”.

In reality, this is the natural two steps forward, one step back and how assets move. There’s just more volatility in this asset class because it’s new, misunderstood, and a lot is happening all at the same time.

Cathie Wood and Michael Saylor

“If you want the US to lose out on one of the most amazing innovation platforms of all time, you keep talking like that.” ~ Cathie Wood

Both had many on point statements, but a few things that really stood out to me where Cathie’s point above that someone must be talking in Yellen’s ear and the ear of other politicians because the political change around Bitcoin has been rather swift. I could not agree more here. The complete 720 shift in political narrative around bitcoin and crypto in the last 6 to 8 months has been shocking, IMO.

Saylor chimed in with a great line himself regarding the president of the United States giving the green light to Bitcoin with the recent Executive Order.

“If I scan the last 100 years of history and I ask, when’s the last time the President of the United States directed the government to embrace a new asset class? The answer is never…” ~ Michael Saylor

Additionally,

“Every crypto exchange that wants to remain relevant needs to build lightning into their application. Not supporting lightning is like not supporting the internet.”

I don’t recall which said it, but I believe it was Cathie. The point was around deflation and creative disruption and these things being the biggest issue. What people are really looking for, as it relates to this, is counter party risk. In the era of the “Great Reset” that’s being too easily tossed around by corporate and political leaders, there is likely a lot of context and understanding that needs to be pondered here.

All in All

My takeaways from the conference were extremely bullish from a fundamental perspective and I think the future is bright, especially on the Lightning side of adoption and buildout.