Like many other complex systems, is Bitcoin doomed to collapse under its own weight? Or is it the first complex monetary system built to withstand entropy?

One of the key takeaways from Scale by Geoffrey West is that entropy kills.

As complex systems grow there is a battle to supply enough energy to support their ever-increasing growth. As resources are converted to energy for growth, entropy (natural disorder) is dispersed, causing systems to collapse under their weight. Eventually, resources and energy are outpaced by a system’s growth rate, causing failure.

We have seen this time and again in our monetary systems and it appears we’re living it out once again. It raises a provocative question: Is Bitcoin subject to the same fate?

It’s known that Bitcoin consumes an enormous amount of energy, and the rise of AI isn’t helping our energy crisis. One difference is Bitcoin has proven to be a means of converting waste gas to energy and acts as a load-balancer for power grids. Making it, in some respects, a net positive. What happens as adoption grows? Will Bitcoin’s energy consumption ultimately become unsustainable, or will innovation offset these challenges? So far, innovation has won out and is another point made by West.

Innovation is the only way for failure not to occur. The question then becomes, how do you maintain simplicity within complex systems and continue to innovate?

The Power of Simplicity in Complex Systems

West highlights that

“highly complex systems have their origin in very simple rules governing the interaction between their individual constituents.”

Both Bitcoin and the Bible share this property. Two systems with fundamental, straightforward rules that give rise to complex behaviors and structures. Their simple rules govern very complex systems, the Bitcoin network and the life we live daily.

Understanding that simplicity underlies complexity is crucial. True scientific analysis should enable us to dissect these systems, but when pushed we lean on bias more so than practicing the scientific method. West points out that when dissecting a system, it’s hard to correctly predict the emergent behaviors of various communities that make up the whole. Emergent behaviors are the unknown momentum shifts that can arise from relatively unimportant parts of a system. So, knowing all the parts doesn’t allow one to predict how the system will act as a whole. Propaganda and social narratives are great examples of emergent behaviors because they show how one seemingly unimportant part of a system can have a dramatic negative consequence on the overall system, causing it to spiral out of control.

Within Bitcoin, we see this every cycle as certain memes, narratives, and half-truths gain cult-like followings that drive the behavior of various groups within the community. Typically, these emergent behaviors anoint new heroes who ultimately fall by the next cycle. It’s during bear markets when cleansing mechanisms reassert the fundamental principles backing Bitcoin.

The Battle Between Stability and Innovation

West explains that as systems scale, they require increasingly more energy and resources to maintain their structure. However, for a system to endure, its core principles must remain intact. Preserving Bitcoin’s simplicity and security is an example of this. It highlights the ongoing tension between Bitcoin OGs and new-aged Bitcoin Wizards. According to West, it's scientifically proven that for a system to last, its core principles—simplicity and the 'dumbness' of it—must be maintained. Is that different than the desire for Bitcoin Ossification?

Stability and security drive the lasting nature of a system well into the future.

The heart of the debate is: does Bitcoin need to evolve rapidly to keep up with its own adoption curve, or does its rigid simplicity ensure its longevity? In many ways, it’s both. The answer lies in how Bitcoin balances security, decentralization, and scalability.

Scaling, Networks, and the Limits of Growth

Power Laws, as West describes, are how complex systems scale. Power Laws have taken Bitcoin by storm.

Over Bitcoin’s 16-year life, it has proven to scale across both time and rate. Additionally, West mentions that scaling networks

“require the close integration of enormous numbers of their constituent units that need efficient servicing at all scales.”

To me, this concept is representative of Bitcoin’s mempool or the lightning network. In the mempool, unconfirmed transactions accumulate, reflecting the network’s ability—or inability—to scale efficiently. There have been numerous instances where Bitcoin’s network has been bogged down and the mempool unable to clear. In these times, transaction costs have skyrocketed and made the network unusable due to time and cost of completing a transaction.

This highlights how networks determine the flow of energy and resources within a system. “They determine the rates at which energy and resource are delivered to cells, they set the pace of all physiological processes.”

Money has never had this capability, not in an instantaneous manner.

Traditional monetary networks are not connected in a way that allows seamless resource allocation and value delivery. This is both a curse and a blessing but is something Bitcoin’s foundation offers. As a decentralized monetary network it can integrate with both on-line and off-line networks. A real innovation. A first and a paradigm shift that has the potential to drastically alter history.

The Accelerating Pace of Economic Systems

“the dynamics of social networks underlying wealth creation and innovation leads to the opposite behavior, namely, the systematically increasing pace of life as a city size increases: …”

West notes this follows the approximate 15% rule—life speeds up in cities, businesses emerge and die faster, and even people walk faster.

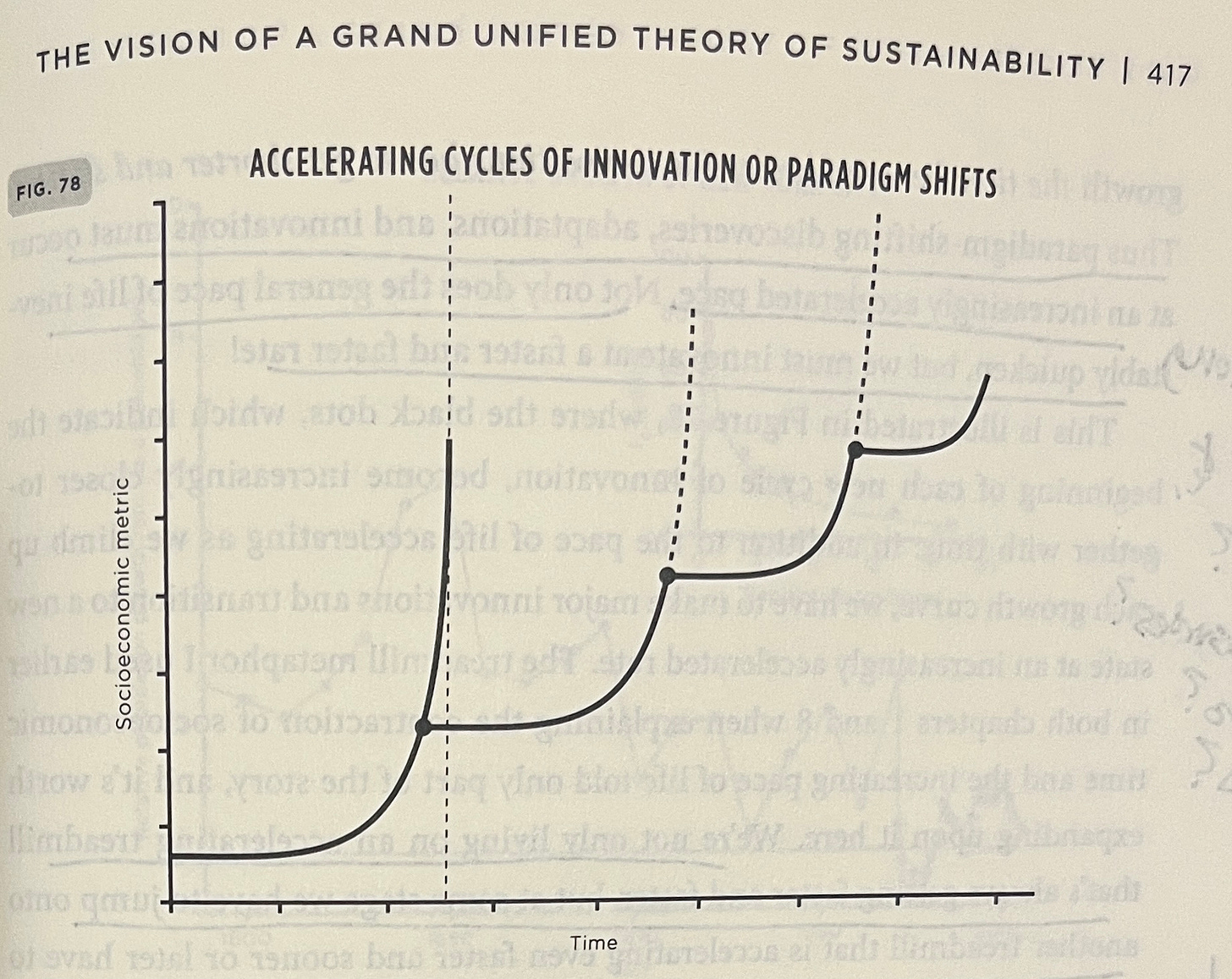

Life is mathematically speeding up and can’t be slowed down. We’ve all felt this as we’ve aged. I believe we are starting to experience this acceleration in our economic systems, where debt cycles and monetary expansions have sped up at an exponentially faster pace.

Without an opt-out mechanism, individuals are trapped on an ever-quickening treadmill. Bitcoin offers a way out. A reset. A natural way of avoiding destruction for complex systems. Bitcoin is a reversion to a monetary system with a fixed supply and simple value principles that contrast with the accelerating chaos and inflation of fiat (paper money) systems.

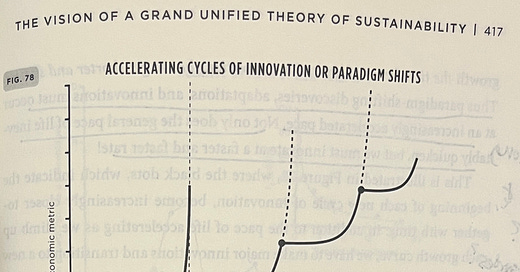

“We’re not only living on an accelerating treadmill that’s always getting faster and faster, but at some stage we have to jump onto another treadmill that is accelerating even faster and sooner or later have to jump from that one onto yet another one that’s going even faster. And this entire process has to be continually repeated into the future at a faster and faster rate.”

This is called superlinear growth. It eventually outpaces time and energy itself, leading to inevitable collapse. As West warns:

“Discoveries must occur at an increasingly accelerating pace; the time between successive innovations must systematically and inextricably get shorter and shorter… If we therefore insist on continuous open-ended growth, not only does the pace of life inevitably quicken, but we must innovate at a faster and faster rate.”

If Bitcoin is to survive, its innovation cycles must keep pace with this fundamental mathematical law.

The Evolution of Wealth and the Reset of Economic Systems

One of West’s most profound observations stems from Galileo’s discovery of scaling laws: if a system does not scale at the proper ratio, it collapses under its own weight.

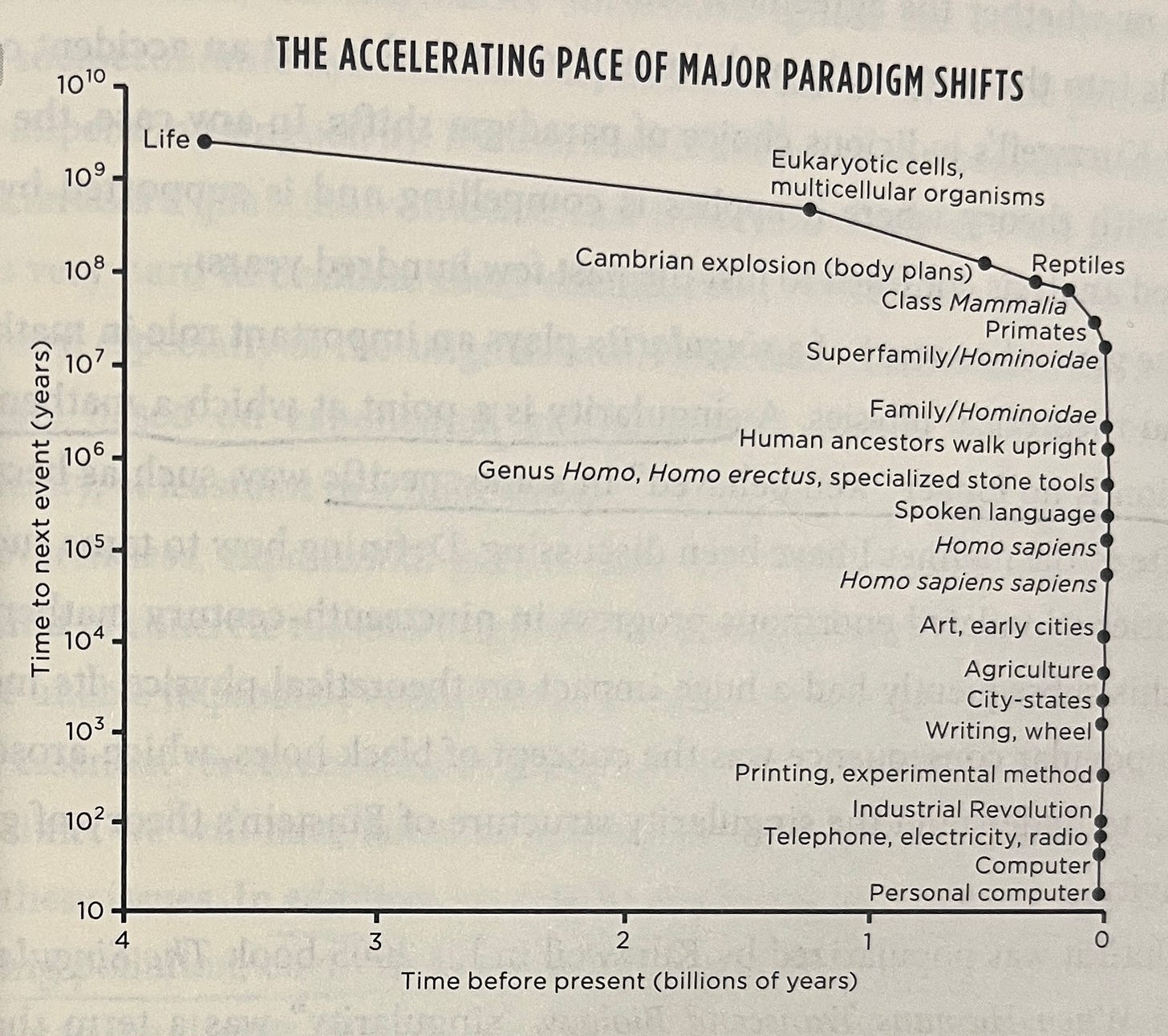

We’ve seen this pattern play out in our monetary systems time and again as our stores of wealth have changed. The weight of each economic system ultimately collapses due to the volume of value it needs to support causing the introduction of new alternatives. You can easily refer to this as a “reset”. Each new alternative adds additional layers of liquidity to a continuously growing system. One that is increasingly more complex. Our stores of wealth have shifted over time as follows.

Artifacts → Land → Gold → Gold-backed dollars → Treasuries → Petrodollars → Debt-based dollars → Bitcoin.

Artifacts: physical items

Land: physical utility

Gold: scarce commodity-based money

Gold-backed dollars: paper money

Treasuries: faith in government issued debt

Petrodollars: oil and global trade priced in dollars

Debt-based dollars: pre-spending of the future

Bitcoin: energy and digital scarcity

Each transition occurred because the previous store of value could no longer bear the weight of the economic system. Bitcoin is the latest iteration, but will it be the last?

West suggests a potential solution: “So one clear strategy for forestalling a potential catastrophe is to intervene before reaching the singularity [death event] by ‘resetting’ the parameters.”

In the past, we’ve seen these resets in our communication and information channels (carrier pigeons → mail → email → internet → mobile → social networks → AI). The same applies to money, with Bitcoin representing the latest monetary reset.

Bitcoin’s Future: The Need for Layered Scaling and Innovation

Bitcoin is the first system capable of efficiently handling both communication and value at scale. However, as history shows, all systems must innovate or face decline. “A major innovation effectively resets the clock by changing the conditions under which the system has been operating and growth occurring. … Having made the transition and ‘reset the clock’ … ”

This is why second, third, and fourth layers of Bitcoin are critical. These scaling solutions disperse the volume (weight) of transactions and leverage Metcalfe’s Law—the value of a network grows as its connections increase. In this sense, Bitcoin is not only a reset for our monetary system but is also an innovation that extends the life of the internet itself. Bitcoin is just another protocol that operates off TCP/IP which is the base layer protocol of the internet, now our standard for global communication.

Bitcoin is not immune to the laws of entropy and scaling. However, if it remains adaptable while preserving its core simplicity, it may continue to defy the fate of past monetary systems. The question is not whether Bitcoin will collapse, but whether its innovation cycles will reset the clock fast enough to ensure its survival.

Final Thoughts: What Do You Think?

Based on West’s work, Bitcoin’s survival depends more on the development of its second, third, and fourth layers than one might expect. Can Bitcoin sustain innovation cycles while maintaining its core simplicity? Can Bitcoin scale and endure where other systems have failed? Or will it ultimately succumb to entropy like the many complex systems before it?