The most important thing the internet did was break the barrier to information. In doing so it freed the flow of information and allowed individuals greater access to knowledge. Knowledge is what leads to change. This slight change in the late 1980s/early 1990s kicked off a tidal wave of innovation that has altered economies, lifestyles, and the future of mankind.

Recently while reading the Sovereign Individual a few passages stood out, not because they painted the picture we currently find ourselves in, but because of how early these prognostications were seen.

The authors James Dale Davidson and Lord William Rees-Mogg were very accurate in their assessment of the shift that would be experienced by the breaking of information barriers during the Information Age. The last 20 years have gone by slow and fast at the same time, but the recent decade has seen a whirlwind of change that mostly aligns with the framework of their book.

Voting is Done with the Wallet Not the Ballot

“When you become dissatisfied with one version of a product or a provider of a service, you can directly express your dissatisfaction by means of “exit.” In other words, you can shift your buiness elsewhere.”

…

“Voting with your feet and your money has the great advantage that it leads to results you desire.”

While the excerpt isn’t exactly groundbreaking considering today’s corporations and government bodies spend more time catering to the feelings of a few over the needs of the many. It is interesting that these passages were written in 1999 well before it was a common part of the American way to cater to “Cancel” and “Woke” cultures. These rallies are only mantras that have gained steam and risen over the most recent decade.

“Instead of spending their disposable income in the thousands of discrete purchases over a year’s time, they would convert this multitude of economic decisions into a handful of political ones. … This model holds all the potential for oratory and persuasion that one finds in politics at the national level. And most of the potential for frustration.”

This is the premise of woke and also on display with the Wall Street Bets/Reddit trading fiasco in early 2021. It’s long been perceived that only Wall Street and professional investors are able to drive and dictate markets because of their ability to pool large sums of capital. However, what we found is that the internet and new technologies have leveled the playing field. Small investors can pool large populations with small amounts of capital and equally move markets in their favor if desired.

As the barriers defined by old monetary models were broken the small investor, with sparse capital, found there is power in the pooling of many other small investors who can all trade in unison while using the same tactics that hedge funds and bankers have used for decades. For the first time, the little guy could take it to the power players. They had a seat at the table and they won. Just as it was laid out in the passage above.

The Return of a Value Based Economy

“With income-earning capacity more highly skewed than in the industrial era, jurisdictions will tend to cater to the needs of those customers whose business is most valuable and who have the greatest choice of where to bestow it.”

…

“objectors will not only complain that informatoin technology destroys jobs; they will aslo complain that it negates democracy because it allows individuals to place their resources outside the reach of political compulsion. … They will support the novel and even drastic means of squeezing resources out of anyone who appears to be prosperous, such as ‘presumptive taxation’ and holding wealthy persons to outright ransom.”

…

“Harvard University political theorist Michael Sandel argues in Democracy’s Discontent that ‘Democracy today is not possible without a politics that can control global economic forces, because without such control it won’t matter who people vote for, the corporations will rule.’ In other words, the state must retain it's parasitic power over individuals, in order to assure that political outcomes can diverge from market outcomes.”

Given the state of things today, the state of our political mess, the controlling nature of social media companies, and the general desire to not deal with big corporations these passages were very foretelling.

As the internet has provided more opportunities, individuals sought real value rather than being sold things by middlemen who stood to profit the most. People have largely been able to find what they need for little to no cost and we’ve all flocked to sources or platforms that provide real value over ones that have high markups.

This has transitioned the business model to one of delivering value rather than profit first. It has also led to higher incomes for those who deliver value while leaving many old and well-known companies for dead. After two decades of this transformation, we are beginning to see a cycle of very wealthy Entrepreneurs being villainized by politicians and citizens to pay more and more taxes.

Noted in the quotes above and on display now, is the premise that as corporations and governments lose control they will do everything in their power to assure the outcomes they desire come to fruition. Regardless of which side of the aisle you stand, if 2020 and 2021 taught us anything it would be hard to argue that you wouldn’t find these points at or near the top of the list.

The Age of Your Information

“… microprocessing will alter the ‘information costs’ that help determine the ‘nexus of contracts’ that define firms. As economists Michael C. Jensen and William H. Meckling suggest, corporations are merely one legal form that provides ‘a nexus for a set of contracting relationships among individuals.’”

“As a result, firms will tend to dissolve as information technology makes it more rewarding to rely upon the price mechanism and the auction market to undertake tasks that need doing rather than having them internalized within a formal organization. As information technology increasingly automates the production process, it will take away part of the raison d’etre of the firm, the need to employ and motivate managers to monitor individual workers.”

…

“In this sense, firms are mainly artifacts of information and transaction costs, which information technologies tend to reduce drastically.”

“Therefore, the Information Age will tend to be the age of independent contractors without ‘jobs’ with long-lasting ‘firms.’ Equally, when economic success depends upon talented individuals, they may receive outsized pay and extravagant bonuses to provide their services, much as professional athletes and movie stars command huge rewards for their talents. In any event, as technology lowers transaction costs, they very process that will enable individuals to escape from domination by politicians will also prevent ‘rule by corporations’. ”

…

“In the future, when information will be freely tradable anywhere on the globe, the power of governments to insulate local businesses from global competitive pressures will be minimal.”

We are currently watching many of these points unfold in markets, in the United States, and around the world as the rise of cryptography, Bitcoin, cryptocurrencies, and the broader Web3 ecosystem are changing the rails of the system we’re all accustomed to.

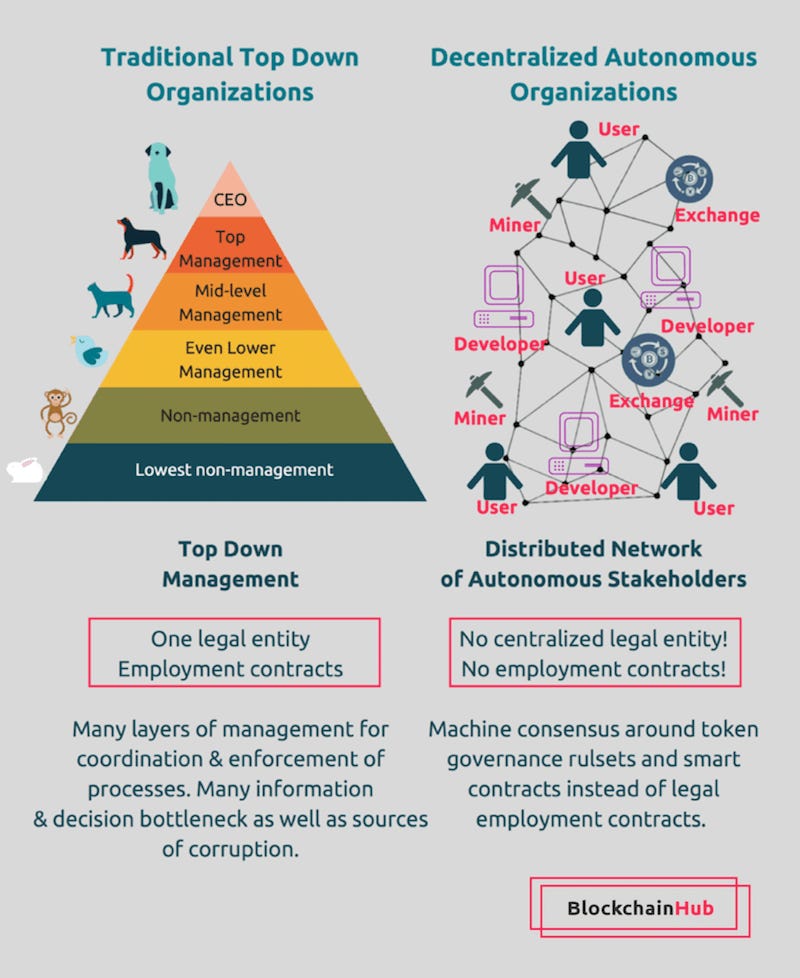

More specifically, one can relate some of these passages to the emergence of Decentralized Autonomous Organisations (DAOs) and Decentralized Finance (DeFi). DAOs are effectively corporations like we’re accustomed to but have no owners and operate off integrations, code, information, oracles, and smart contracts. All of these components work at the moment merely off of market pricing handled by technology, algorithms, and systems more so than people. The latter integrations and connections of systems are where DeFi fits in.

Your Social Network is Your Reality

“We are rapidly moving to a world where information will be as completely liberated from the bounds of reality as human ingenuity can make it. Certainly, this will have tremendous implications for the quality and character of the information you receive. In a world of artificial reality and instantaneous transmission of everything everywhere, integrity of judgement and the ability to distinguish the true from the false will be even more important.”

After the fact, there couldn’t be a more obvious prediction. What we are currently living out is exactly as it was laid out in the last line. Most of the chaos seen in the last couple of years is either from leaks of true information that spreads virally but seems fake, or fake news that spreads rampantly and appears true.

Either way, the conundrum has left most shaking their head in a state of disbelief unsure of what exactly to believe anymore. It’s almost to the point where you can’t believe it unless you saw it with your own eyes. From a societal standpoint, it’s definitely a slippery slope and a state of chaos that is typically only seen every few hundred years as one empire declines while another is on the rise.