Broken Values Expose Broken Money

We only pay attention to where we place our focus, when it costs us more

The truth about money is a lot like the truth about Christianity or religion in general. Embedded in both, spirituality and money, are truths that most people don’t want to face.

The short and simple answer: Society is in the process of cutting out the middleman… across the board… because broken values and incentive structures have finally pushed far enough to break the money. Leaving people to pay attention and look for better solutions.

This is the chaos we find ourselves in. It’s present in our business models, geopolitical models, and our local political and monetary models.

The transition has been slow but has engulfed most sectors. However, those few areas that have resisted are where the most power and control exists.

These sectors, and their leaders, now find themselves under an immense amount of fire. Creating an immense amount of backpeddling and finger pointing as one lie untangles to another. The groups at the top are fighting a two-headed monster. They find themselves in the dual crosshairs of technological monetary innovation and an angry mob of global citizens seeking something better.

Naturally, as people shift where they put their trust and how we communicate value, it forces a realignment of the faith we place in money.

Old winners will be the new losers. Later we will hear as many Riches to Rags stories as we’re accustomed to hearing about Rags to Riches.

Why? Because decision makers of the old guard, those running monopolistic entities and debased monetary systems, aren’t going to attempt to fix something that threatens their empowered lifestyle; regardless of the tax and expense it lays on others. They don’t perceive it to be broken and adore the self-serving nature of the system.

Markets Have a Way of Forcing Participants

Markets have a way of forcing participants to take the medicine they knowingly put off. And when it matters, markets also give people the power to force change… by shifting to where we move our wallets. This is what has changed. As digitization has made its way to money, it’s gotten much easier to move your wallet. Disrupting the apple cart that was otherwise thought to be stable and very profitable. The primary mandates of Central Bankers are shifting beneath their feet.

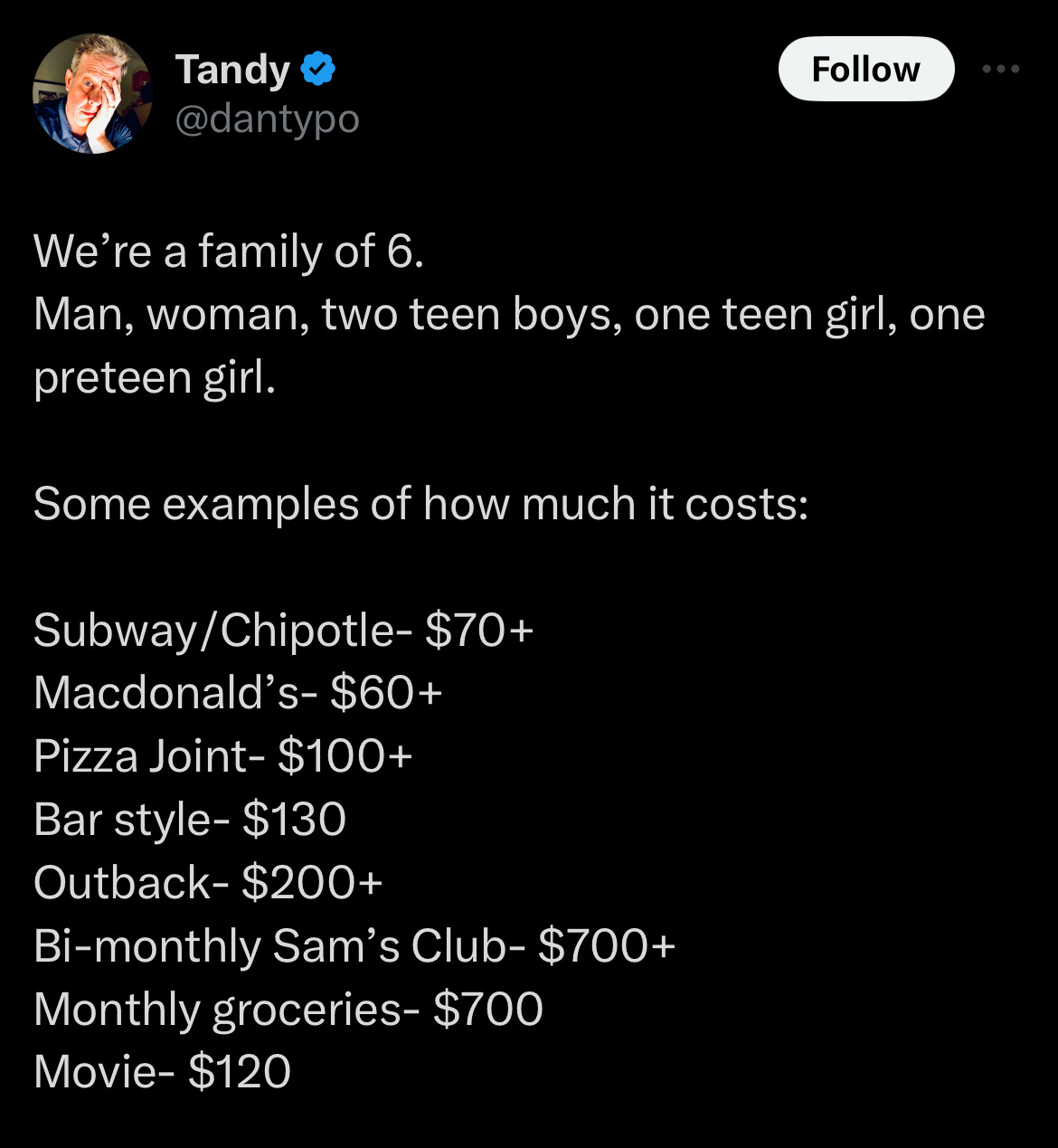

Change comes naturally, but the pain has to get high enough first. We’re at the inflection point because the average person is feeling pain and seeking better ways.

This is how markets naturally force high margin models to adapt. People start substituting. They change where they perceive value based on price, then move their wallets to a new place.

You’ve seen it with the rise of simple, flat fee product bundles. They started primarily in tech based businesses and have since emerged in almost every service industry at this point. They are everywhere clients interact and this rise has significantly shortened the lifetime of the average corporation. It’s adapt or die.

The latest models ask for a clean flat cost and force fee compression while providing scale.

Fee compression isn’t so much a symptom of competition, *but* rather a symptom of consumer desire. A symptom of people moving their wallets based on misaligned values.

The en vogue thing in successful business models today is having simple, clear, and understood pricing. Delivery on demand. It’s no frills, here’s what you get while reducing all the bloat… which typically is where all the hidden costs come from. This is where users are moving their wallets.

The fight lies with those stuck in old models. Stuck in their old habits, while the rest of the world adopts new tech forward models. The best businesses figure out a more streamlined way of delivering a consumable product in a way the consumer wants, i.e. they figure out how to deliver value.

We’ve moved past the model of here’s what we produced and you’re gonna like it. That was the industrial age.

This is the digital age, where figuring out a bundle is much more the way forward for service industries as SaaS was for tech 15-20 years ago.

How does this relate to money and values?

The easiest framework for a traditional market participant to understand is relating the Bitcoin network to the dollar network.

Bitcoin, in the digital age, is similar to the dollar & gold in the industrial age.

All other currencies in the system react to changes in the dollar just as in the new financial paradigm all other digital currencies react to changes in Bitcoin.

With all the chatter happening around sidechains, it got me thinking about where is the real value in a non-physical world?

Is this a money problem or a wealth problem? Because they are two completely different issues.

For the former (money), we’ll always find a new replacement. Until the values and principles break again. It will be the latter (wealth) that pulls us out and pushes us forward to new heights.

Bitcoin is the new money that will provide rails for value to be integrated much better into our ways, systems, etc. in a manner that helps redistribute wealth to start anew.

Just as it happened when we moved from an Agrarian society to an Industrial one. It is happening again.

Once the money breaks, people realize it through pain. We then shift, re-prioritizing the satisfaction of our values and needs. This change is slow but drastic and causes a shift in what is required from the social constructs or units we call money.