The battle between good and evil dates back to the Garden of Eden. It’s a battle that has stuck with man for centuries. The root cause? Human Greed.

It seems that every good system on earth has at some point turned evil, and many bad systems have turned back good. Parables from the Bible detail the origins of this struggle between good and evil, while men and women of the world relive the circumstances time and again; century after century.

Are we witnessing another one of those stories?

Satoshi’s Solution

Satoshi created Bitcoin as a solution to the evils that have come to exist within our global monetary system.

A great invention. Though an unpopular opinion, Bitcoin is an invention that is not uncorruptable…

This is now a political game

~Woonomic

Bitcoin is an innovative invention that will drive adoption in new ways across the internet for decades to come.

Though, not without a challenge from the evils rooted in our ways. In its young life, 13 years, we’ve already seen Bitcoin unable to evade the evils of man and his systems. As the adoption of digital assets has approached mainstream, we’ve unfortunately seen a bending of the Bitcoin knee. Each wave, we see major Bitcoin advocates and influencers bend to VCs, politicians, and Wall Street evils. Why?

For money. For notoriety. For Greed.

The perils of evil have a way of enticing the desires and tendencies of man. When bear markets strike it becomes clear who has been swallowed by these evils of the world.

Evils rooted in the Rothschild formula, where one creates a market and then plays on both sides in order to stand in the middle and scalp a fee.

On display, is a hidden and deceptive form of greed that yearns for notoriety and more money — at any and all cost.

True believers are those that understand and live by the laws and principles of money defined by the kingdom and outlined in the Bitcoin Standard. Though that does not mean we are free from the fear and corruption that exists.

The Crypto Ecosystem’s View of Good vs. Evil

Bitcoin vs. Ethereum. That’s all you hear in the echochambers of Bitcoin Twitter. So much time energy and effort is spent bickering on points that may not even really matter, for two reasons:

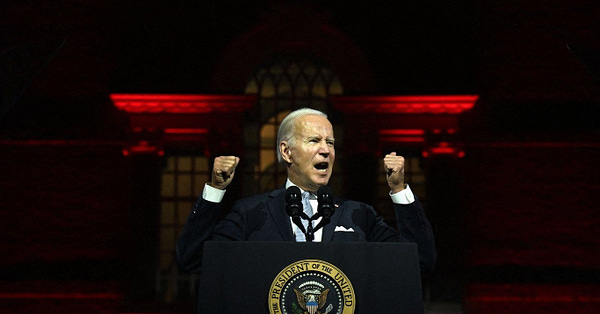

They are found in our existing monetary system gold vs. stocks

Bitcoin and Ethereum aren’t even trying to solve the same problem. It’s apples and oranges.

Bitcoin is the “Good”

A digital version of a collateral asset. It is digital gold. A base layer money. There is only one. Though throughout history base layer monies eventually get levered. We’ve watched the early signs, dating back 2018. And, in 2021 and 2022 it became clear and openly obvious.

So yes, Bitcoin is good, but it’s proving to have chinks in the armor, just as every other monetary system has. As systems age, man’s greed for more leads him to a greater desire for credit than sound money. It’s about the people, not the money… That’s where the problems lie.

Bitcoin is scarce, there will only ever be 21 million. It’s unique, there are no others as scarce or as secure. It’s trying to solve the problems we find in our existing credit, fiat money. And it’s now in a full-fledged battle with the temptations that led us to broken fiat money.

Ethereum is the “evil”

A digital upgrade of our credit card networks. It’s similar in characteristic to stocks and is a base non-money layer that acts as an integrator to both monetary and non-money systems handling the tech and distribution of different types of internet value and projects within a budding ecosystem. Ethereum breeds cutting-edge innovation(s) at the expense of security and under the guise of complexity. All to satisfy man’s greed and passion for more. It is a technology that offers a way to lever and create risk within the confines of digital collateral.

Ethereum is not scarce. It’s unique… until it’s not. There are others but none that are able to deliver; yet. It forgoes security for speed and connectivity. It’s not trying to solve the problem of money but rather the challenges of accessing and moving value.

It’s in essence the illusion of money. This is exactly what we find in most credit functions. The illusion of having more than one actually does.

The Real-Time Rebuilding of What We Already Know

Gold is a collateral asset, similar to its digital brethren Bitcoin. It’s relatively scarce, secure, and unique. It is one. It acts as a base layer money that has been levered to the point of no return.

Credit is currently more abundant and “useful” than the underlying collateral, a symptom that arises during every major monetary system peak. Within the crypto ecosystem, we’re seeing the buildout and reconstruction of credit; it’s a story that is not new but repetitive.

When you apply a microscope to money, we find there is no “best” form. There are many forms of money, and all of these monies unequally qualify as a medium of exchange, store of value, and unit of account. But, there is no money that does all three things well.

Therefore, we find ourselves in short-term cycles of credit expansion and contraction which creates booms and busts over the longer-term cycles of money destruction and recreation.

Stocks, like Ethereum, are not scarce. They are not all that unique, there are thousands. They are secure as long as there’s revenue or hype, and they offer a greater speed of riches than base layer money. Basically, stocks are not boring like collateral assets; Bitcoin and gold.

If 2021 and 2022 taught us anything, it’s that you can build a following by spouting the zealous mantras of sound money, then flip the switch to profit from the credit side of the same echo system.

My guess is we are only in the early innings because we’re now seeing a lot of political interest in both Bitcoin and Crypto. Political movements come with baggage and corruption.

Beware of The Political Circus

An excellent quote from the letter above from Edward Snowden. One that makes for a cliffhanger of an ending.

Think for yourself. Ponder. Question all “truths” and pray for wisdom to navigate the propaganda we see daily in the battle between Good and Evil.

“Better that right counsels be known to enemies than that the evil secrets of tyrants should be concealed from the citizens. They who can treat secretly of the affairs of a nation have it absolutely under their authority; and as they plot against the enemy in time of war, so do they against the citizens in time of peace.”

― Baruch Spinoza