How Cryptocurrencies and Their Cult-Like Tribes Could Reshape the World of Finance

Each network has unique capabilities and advocates that believe as if it's a religion.

TLDR… Crypto isn’t necessarily “new”. Bitcoin is a superior financial network to what we have today and Ethereum/DeFi is akin to the buildout of credit card networks in the 1950s. It’s not so much that things are “new” as it is that we are seeing an evolution of the internet where protocols can integrate and transmit value over the web… Web3.

Deeply Rooted Beliefs…

If you’ve spent any time on #CryptoTwitter, one thing is for certain. It feels like being part of a cult-like following. One where if you aren’t for the network then you’re against it.

The downside is it feels exactly like what’s wrong with all of the political bickering between parties in the US. If you’re a Democrat then you must be an insane virtue signaler and if you’re a Republican you must be an idiot Conspiracy Theorist. In reality, there are some truths and many falsies on both sides. But, you’ll never convince either party of it. The same rules appear to apply to Bitcoiners and Eth-heads.

On the upside, in crypto, there’s definitely no shortage of talent looking to flip the very next person they come into contact with; regardless of coin choice. Oh, and don’t even think about flipping a Rippler.

Fortunately or unfortunately, depending on where you stand I’m starting to believe this toxic tribal nature is one of the reasons Bitcoin hid in plain sight for more than a decade. During that time it had outstanding returns relative to all the other investment choices and almost no takers other than young or fringe investors. For the most part traditional normies and institutions steered clear if for nothing else because they didn’t want to be part of the bickering and meme economy. Oh, how time changes things!

Here’s the Breakdown

Bitcoin Maxi’s tend to have a fairly high level of toxicity and shoot down any idea, thought, or question that isn’t #bitcoin; the end. period.

The primary focus is security first… and security at all costs… nothing else matters. Bitcoin’s main offering at this stage is acting as a store of value (sov) and at this point, that’s something pretty desired by most of the world. Not to mention it’s proven as a very good savings technology which is one thing most citizens clamoring for.

Eth Maxi’s, admittedly I don’t know as much about, but by and large, they appear much more into cranking out fancy code, buzzword laced whitepapers, and tend to seek ridiculous yield regardless of the risks. Security is seemingly a second thought as long as they can code in the latest tricks and fads. It’s all the things that get you excited but might leave you feeling empty when you see the headlines of yet another hack.

Ethereum and ERC-20 token’s main offering at this point is innovation targeting the financial industry. Remember, there’s definitely a product/market fit here.

Why the Battle?

Though there’s seemingly always a battle between the two groups, is there a bigger picture being overlooked? Isn’t there room at the table for Bitcoin and Ethereum?

Both are foundational networks at a time when our current networks are lacking security and innovation and frankly don’t transfer value very well. From that perspective, Bitcoin focuses on stability and Ethereum focuses on innovation. In a synonymous way, their differences are not all that different from the traditional market battles between Growth vs. Value or the S&P 500 versus the Nasdaq.

It’s fitting that Crypto would have its own version of Growth (Ethereum) and Value (Bitcoin).

So why all the fuss? There should be plenty of room for both, no?

Where’s the Fit?

In the book Payments Systems in the US, it became very clear to me that we currently sit in much the same position as we sat in the 1950s.

During that time the financial system was under a mass overhaul, moving from paper to digital to make traditional banking processes more efficient and electronic. The point was to innovate in a means that allowed transactions to happen at speeds that matched the expectations of the consumer and better fit within the needs of their everyday lives. There was a business need to process financial transactions faster.

It seems to me that today (2021) and for much of the last decade we sit at pretty much the same juncture. Today, in the digital age, the resource driving the economy is data and information. So why is our money still paper, unconnected, or on siloed financial networks?

What better form of money than one that operates off data and is interoperable with machines, people, and the internet… which by the way is the backbone of today’s business model.

Is this Not a Description of Bitcoin?

(Payments Systems in the US)

“Large-scale, open loop payments systems are highly efficient and scalable— the envy of many other industries that would like to achieve similar levels of smooth interoperability. (Think about the exchange of electronic medical records, for example!)”

Fear of losing Control… For Reasons that Don’t Add Up??

“A downside of this structure is the inherent inertia in its systems. The fact that multiple remote parties can interact with each other easily, relying on a common body of standards, rules and liability frameworks, also means that it is very difficult to change these standards.”

Isn’t it a benefit that parties can interact easily with each other?

Isn’t it a benefit to have a common body of standards and liability frameworks?

Isn’t it a benefit that it’s difficult to change the rules and standards?

Is DeFi the Credit Card Network of the 1950’s?

The bank networks back in those days were great. They allowed business to happen, but not necessarily at the pass that people began to move about in the post World War II era, thus there was a need for innovation and that’s exactly what happened. Through the use of new technologies and consortiums, new means of digital transactions were conceived in the form of what today we know as the credit card networks.

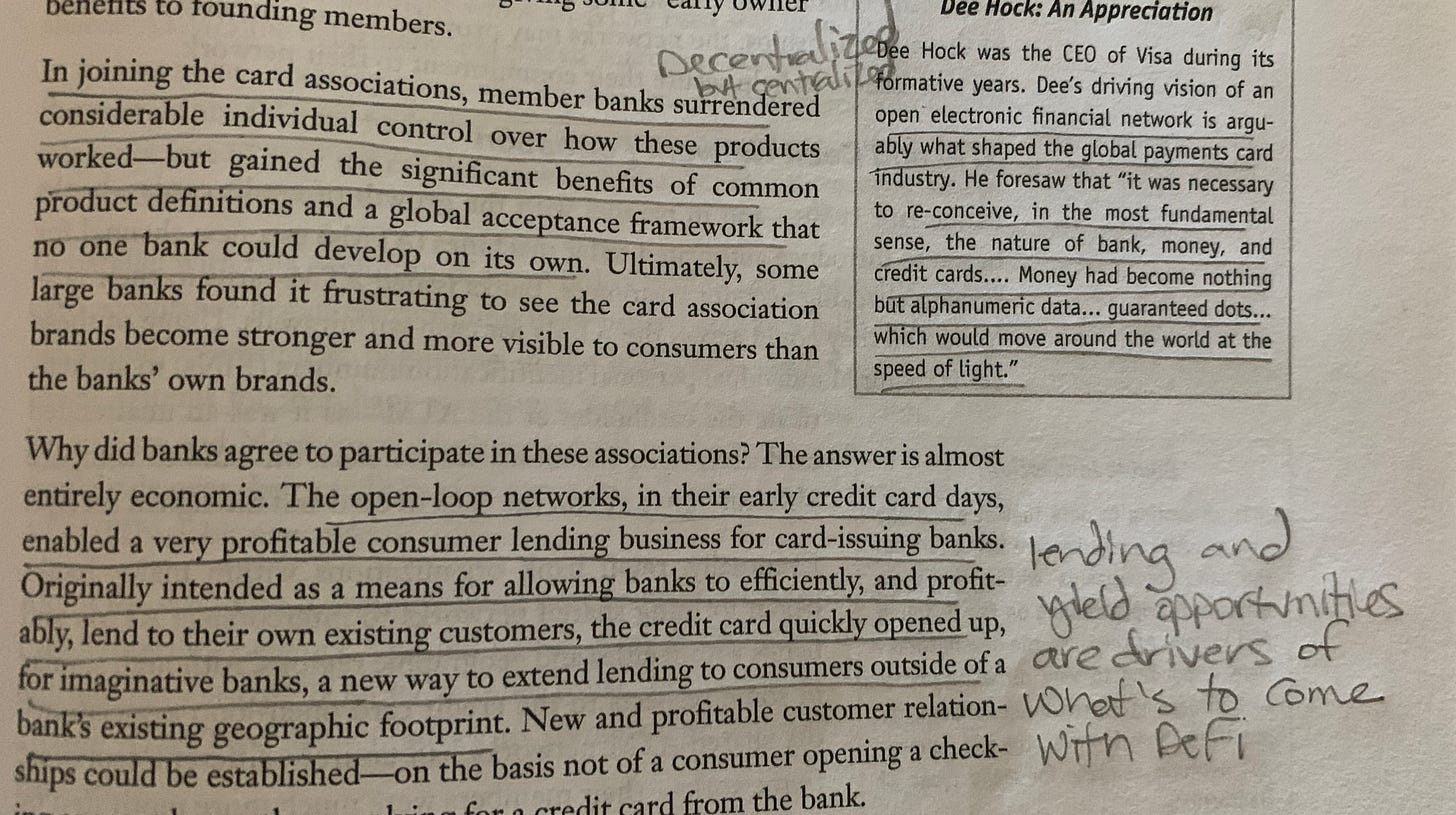

Under the guise of, “there is nothing new under the sun”, DeFi feels like it mimics what credit cards did back in the day. These connectors are built on top of existing Crytpo Networks to increase connectivity and innovation on the base technology layers in a manner that expands and connects various parts of the financial system that are either disjointed or inefficient. In simple terms, this is almost exactly how credit card networks were structured in relation to the banking networks of those times.

In a sense, it seems DeFi could easily be the APIs of banking at a minimum, and it wouldn’t surprise me if in 70 years people look back on this part of innovation in the same light that I am looking upon the advent of credit card networks.

If you replace a few words in the first section below, one could easily assume you were talking about the Ethereum network.

And in the latter half, the bottom paragraph, one can easily see the similarities to what we’ve seen built out between 2018 and 2021 as it relates to all the yield options becoming available on both Bitcoin and Ethereum protocols.

Much of the innovation has more or less been new words for concepts we’re all pretty comfortable with in terms of how the infrastructure and plumbing of the financial markets work.

It’s not so much that it’s really anything new as it is more advanced technologies being used in innovative ways that weren’t capable until the internet era.

Regardless of whether you are a Bitcoin or Ethereum Maxi, the future is bright in regards to the changes and innovations that we should see take place in banking over the next 5 to 10 years. And that’s before we even get to the topic of digital wallets and each individual having the capability to be their own banker!

It should be a great new world… Until next time!