The world is one giant ecosystem powered by nature and all the mini-ecosystems which make up the whole. If we take one relatively unimportant component out of nature then we upset the entire balance causing unintended consequences to happen at some point in the future. Sometimes these disruptions are instantly apparent and other times the cracks don’t show up for years, decades, or centuries.

The point I’m aiming to make is that if the world naturally operates off of many interconnected ecosystems then why shouldn’t we expect our money and monetary systems to do the same? After all, money is a globally accepted form of communication but it’s sparsely connected.

We (humans) are only one small part of nature’s ecosystem and money is only another small piece.

Money is a tool, a monetary technology used globally to communicate value. So, if nature operates perfectly with many ecosystems making up the whole, then why do we expect our money to operate flawlessly without many connected or interoperable systems?

What is interoperability?

In the case of money, it’s the ability to integrate or connect many diverse sets of computer systems, people, networks, or other communication channels for the sole purpose of delivering and receiving value.

To this point, our money has been in a sense, siloed.

Historically, the design of money and financial systems have been the opposite of how nature is designed. Money has been tightly held by kings, clergy, or central bankers. It’s been regionally or centrally controlled with only minor levels of interconnectedness.

If we compare money to nature, there is one base layer - water.

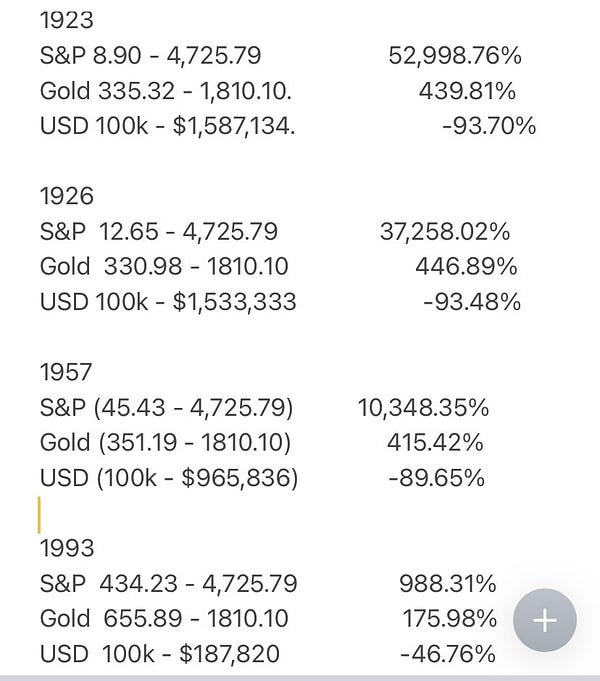

All else stems from or survives because of water. However, just because water is required, does not mean it’s the only thing in nature. Essentially, we have a similar structure with our current monetary system. We have gold as a base layer (though no longer linked) and US Dollars as an extension with US Treasuries, Eurodollars, and other fiats adding additional fingers across the monetary ecosystem. (for a quick synopsis read Layered Money). We are entering a phase where Stablecoins are yet another extension as they appear to be playing the role of Eurodollar 2.0.

Sound Money is Crucial But Not the End All Be All

Today’s monetary networks are cumbersome and disjointed. Relative to nature, they are very lightly connected and lack transparency, encourageing leverage and greed that eventually creates single points of failure. These disruptions impact the entire monetary ecosystem instead of being contained within the local networks they are created within.

This point of failure is much less prevalent in nature, though it happens from time to time. Nature has a more pure level of interoperability which provides the resources needed for all ecosystems to live, eat, sleep, and breathe. When nature’s networks are broken or disrupted they generally self heal since there are many paths to continue forward. They generally only fail when large swaths of key parts of the chain are disrupted (usually by human intervention).

For example, if one seemingly unimportant part of nature, say rats, is disturbed they will naturally migrate and start again. But, if the entire population of rats is wiped out then some other part of the larger system begins to falter, setting off a chain of disasters that eventually cause larger parts or the entire system to get out of balance.

While seemingly small, rats are part of the food chain and a cog in the wheel that keeps the world’s ecosystem spinning. In a widely connected system, there are options for self healing if something happens. In sparsely connected systems, like our financial system, removing one seemingly unimportant component causes the entire design to falter. Most recent examples are 2020, 2018, and famously the Great Financial Crisis of 2008; among many others.

The Value of Interoperability

In our current financial system, there is much less integration among the many layers and silos.

To me, this is the true value of Bitcoin and the broader crypto ecosystem. The ability to provide a broader level of interoperability within the financial system. In many ways, this would mimic the makeup of nature’s interdependent systems.

Could Bitcoin run parallel with gold acting as an adjacent digital layer that integrates with our physical layer? Sure. The Chinese have very effectively created O2O (Online 2 Offline) systems that are merging the physical and online worlds in a way that creates many more seamless and innovative efficiencies.

The opportunity is that cryptocurrencies are a layer that provides more digital interoperability with our physical layers. In this design, Bitcoin acts as the sound money base and Ethereum drives the innovative layers of smart contracts and connections, effectively is the layer of technology. NFTs, Web 3, etc are navigating the path of cleaner proof of ownerhip and/or certificate of authenticity. This is just a simple breakdown and I recognize that there are gray areas and levels of overlap among the three. That’s what takes time, energy, and effort to hash out through failure. I discuss many of these points on my podcast, Navigating Bitcoin's Noise.

Though the tech layers are less secure, they do provide and encourage levels of integration and innovation that will broadly connect the human monetary system in a way that more aligns with what we see in nature’s interwoven ecosystem. These layers are key to removing silos and the disjointedness that currently exists in our financial system. They provide a much broader sense of connectivity and availability. You simply can’t beat the internet in these areas, so it makes sense that we use this as an advantage and bring the internet to our money.

As we continue down the path of building out the internet of money there will be roadblocks, headaches, and hacks. Regardless of the period, cops and robbers have always been part of the financial system.

As we move forward I believe this level of innovation and access will provide the next wave of growth all across the globe. We would see true globalization as opposed to what we’ve previously called globalization. From this viewpoint, it’s important that we understand the value and function of nature’s networks, so that we can replicate them in our monetary system to provide a better means of transmitting value.