Let’s take one last look at 2022. It was a challenging year for almost all asset classes. It was the worst year for stocks since 2008 and the worst for bonds in decades (if not longer). The macro environment saw a major shift in 2021 and 2020, one not seen since roughly 2000.

In 2022, relative to the dollar, only two of the primary exchange traded asset classes were positive on the year - commodities and cash. The most important thing investors were reminded of in 2022 is that we live in a dollar denominated world.

The unit of denomination reigns in turbulent times. While narratives view the dollar as an outcast the fact is, it’s still king in terms of global denomination, for now. So, like a seesaw, when one side goes up the other (dollar denominated assets) must go down. That’s just how a seesaw works and that’s what we saw in 2022.

source: https://stockcharts.com

Long duration bonds had their worst intra-year on record. Trading down almost as much as high-flying tech stocks. Simply put, there weren’t many places to hide this past year.

The S&P 500 (stocks) was down -27% from high to low. Though it finished the tail end of the year with a nice rally.

Digital assets: Bitcoin, Ethereum and others had their “2008” moment as exchanges collapsed on too much leverage, rehypothecation, and traditional Wall Street games that seeped in as the asset class ramped into euphoric highs.

It’s a classic bear market cycle for cryptocurrencies and will probably last another year to year and a half.

Though not up on the year, gold held its ground and value stocks made a comeback after a decade of lying on their deathbed.

All in all, 2022 was a year of risk-off. Are we seeing a shift from growth back to value? That’s likely one of the bigger questions to watch as the economy continues to slow and recession chatter looms in the background.

It Turns Out There Was Inflation...

Truflation is an index that uses blockchain principles to gather mass data points, remove human subjectivity, and report an unbiased view of inflation across the economy.

The index above was released in 2021 and provided one of the better gauges for actual inflation throughout 2022.

They were ahead of the curve, showing inflation increasing long before the FED began hiking rates and showed peaking inflation around the time rate hikes became a thing.

On the year, the Federal Reserve hiked rates seven times taking rates from zero in January 2022 to 4.25-4.50% in December.

As shown above, inflation peaked at around 11.97% in March 2022 and has been on the decline ever since. In early January 2023, inflation stands at 5.69%.

The Impact of Printing Money…

Source: Morgan Creek Capital Management

At some point over the last few years, you’ve likely heard about the evils of the money printer. The charts above reflect this impact.

When money is pumped into the system (M2, money supply, increases) it pushes inflation up and encourages investors to seek risker assets… Think meme stocks of 2020/2021 or high-growth tech. When the spigot turns off that money flows back out as inflation begins to dampen growth.

The chart on the left shows the Consumer Price Index (CPI), the most quoted gauge for inflation, shifted forward (gold line) to better show its relationship to money supply (M2 black line).

As money supply fell, inflation began to abate. Refer to the Truflation chart to see inflation coming down from almost 12% to near 6% at the time of this writing. The misstep in money printing coupled with supply chain issues led to a turbulent year in the markets causing many assets to fall and intermarket relationships to break.

On the bright side, for the first time in over a decade, we have a decent savings rate with treasuries money markets over now over 4%. The downside is that we may see higher costs of capital for some time, per the FED.

The Big Question. Are Recessions Still a Thing?

Economists and market participants tend to lean toward “yes”, with the common thought being a likely recession in 2023. The FED, however, seems to stand confidently in the “no” camp.

Though data from the New York Fed paints a conflicting picture. Their forward looking recession probability data is in the zone most commonly related to all other recessions, since 1959. The NYFRB data below, among other things, suggests we are most likely already into a slowdown and should probably be prepared for a worst-case scenario in 2023.

No need to ring the alarm bells or run for the hills. Recessions are part of economic activity. However, it may be a good time to refine our Five Uses of Money and make any substitutions that make sense for our lifestyles.

Click here for a brief study I did in September on drawdowns and recessions.

Valuations Have Cooled... Still Historically High

Consumer Sentiment is Low (contrarian indicator)

Manufacturing Indicators are in Recession Territory

So, What About 2023?

If we are in a recession now, by the time the Federal Reserve comes out and announces it, we’ll likely be coming out of it already.

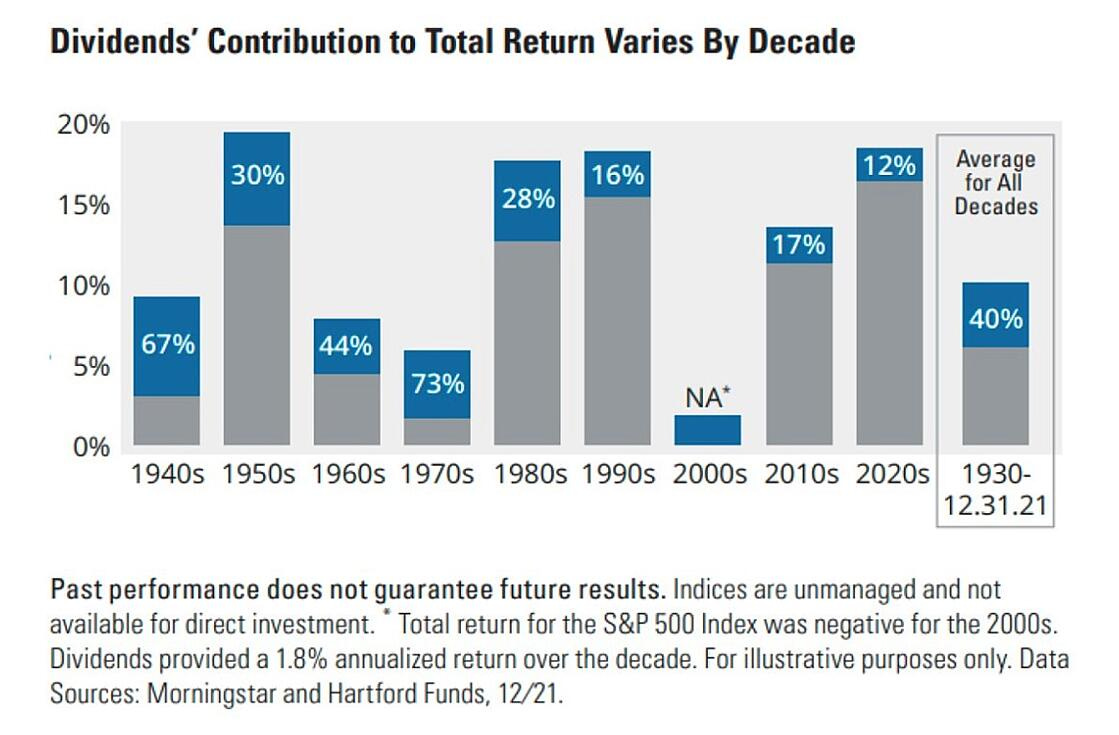

So, with the S&P down roughly 20% from the highs we should continue to look for areas to dollar cost average and be on the lookout for opportunities… the types of investments where the dividends and future value are worth a good bit more than today. Yes, it’s boring, but dividends pay into the future!

Great investors buy things on sale and prefer not to pay full price. Stocks could go lower for sure, but things are beginning to go on sale.

If things stay down for longer, dividends and income oriented investments will buffer the losses over time.

Is The Shift to Value Upon Us??

For over a decade value stocks have been left for dead. Blue Chip, steady-eddy stocks that pay dividends have been continually passed over for high-flying tech stocks and growth. 2022 might have been the year this changed. Going forward, with expected higher rates, dividends most likely will overshadow growth prospects.

In 2022, many of tech’s best were down 30-70%+ from high to low.

Google (-45%) Apple (-31%) Netflix (-73%)

Amazon (-52%) Salesforce (-50%) Facebook (-74%)

Tesla (-73%)

At the same time, most value stocks were flat to up. QQQ, which represents tech, was down -32% high to low while VYM, which represents value, was down only -6%.

Market trends take time to work themselves out, but this is a shift worth watching in the coming year.

source: Equity Investment Corporation

It is a Good Time to Review…

Change is normal. Change is necessary. Change is guaranteed.

Has your balance sheet, cash flow, or environment shifted enough to change the priority of what is most important to you?

• How can we make the 5 Uses of Money work for us?

• Are we using our money in areas that are the most filling?

In some areas, it may mean trimming the fat. In other, long-term oriented areas, it may mean spending into the downturn. In slower times, reshuffling your needs and wants can help ease the emotions that can zap us of our energy.

Head into 2023 with a plan for family, health and wealth. What are your main priorities for the year? What is it you really want to get done?

Disclaimer: The opinions conveyed in this writing are my own personal opinions based on data and information I have researched. The intent of providing this material is purely for informational purposes, as of the date hereof, and may be subject to change at any time and without notice. These resources do not intend to constitute accounting, legal, tax, financial or other professional advice. Visitors and readers should not act upon the content or information found here without first seeking appropriate advice from a trusted accountant, financial planner, lawyer or other professional.