The Primary Problem in the Global Financial System Today: Trapped Liquidity

Trapped liquidity is the systemic fragility beneath the surface of global finance

Overview:

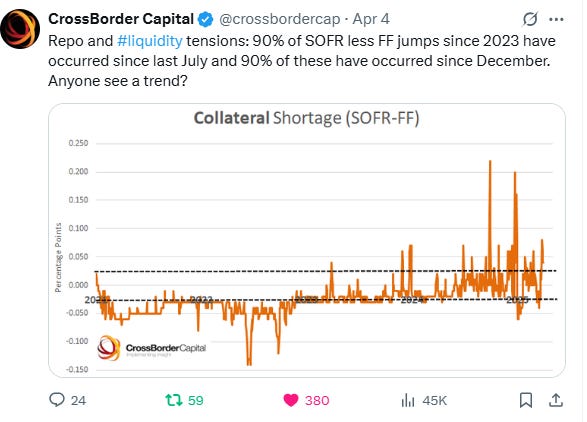

Trapped liquidity is the systemic fragility beneath the surface of global finance. It is the product of decades of layering derivatives and leverage on top of reserves and collateral frameworks—creating the illusion of ample liquidity while reducing access to real, spendable cash when it’s most needed.

🔁 Step 1: Reserve Creation ≠ Consumer Access

When the U.S. Treasury issues debt, the resulting reserves are credited to the banking system, not the real economy. These reserves:

Can't be used directly by consumers or non-bank entities.

Mostly serve to settle interbank payments, backstop leverage, or comply with regulatory ratios.

Only enter the real economy if banks choose to lend and consumers choose to borrow—a fragile transmission mechanism.

In a low-rate regime, reserves are used to amplify risk and leverage. As rates rise, these reserves become dead assets, unusable for real growth or inflation control, creating a monetary stalemate.

🌍 Step 2: Global Demand for Dollars + the SDR Workaround

Since 2017, the path of Special Drawing Rights (SDRs) has generally mirrored the Treasury General Account (TGA)—the Treasury’s checkbook.

However, during liquidity events, this relationship diverges. At times in 2017, ‘18, and ‘19, they decoupled, and in 2020 there was a notable lag — coinciding with a 69% expansion in SDRs.

Recently, we’re seeing signs of divergence again. SDRs and the TGA are now moving in opposite directions, just as rumors of liquidity strains—and a shortage of dollars—begin to surface.

As global dollar demand rises, especially during crises, access becomes strained.

Foreign central banks and shadow banks scramble for USD liquidity, but traditional FX swap markets often seize up.

Cue 2020/2021: The Federal Reserve quietly expanded its swap line network, adding 9 new central banks to its dollar liquidity facilities. An extraordinary and under-discussed move.

💡 This was a symptom of trapped global liquidity: dollars existed, but were inaccessible outside the U.S. system.

The IMF’s Special Drawing Rights (SDRs) suddenly made sense. Though long ignored, they provide a global liquidity relief valve, because they:

Can be exchanged between central banks for hard currency (USD, EUR, etc.).

Don’t require new sovereign debt issuance.

Are neutral reserve assets, bypassing national political deadlock.

🧮 Step 3: Liquidity Math—A 27.6% Expansion?

In 2020: 40% of all dollars in existence were printed in less than 12 months.

SDR allocations were expanded by 69%, the largest increase in history.

Trading Economics shows a 3x increase for the US.

🔓 Multiply the two (0.40 × 0.69) and you get a theoretical 27.6% increase in global liquidity capacity, if that liquidity were ever unlocked. But here's the problem: it’s trapped.

SDRs sit idle unless exchanged.

U.S. bank reserves are locked inside regulatory pipes, inaccessible to non-banks or foreign institutions.

Only shadow banks, hedge funds, and central banks with access to financial engineering tools like swap lines, FX repo, or bespoke vehicles can tap it.

💎 Step 4: Enter the Jewel Box and the Alphabet Soup

Every major liquidity crisis brings with it a new facility, a workaround to unlock “money” from where it’s trapped. These are not systemic solutions, they're bespoke engineering patches:

TARP, TALF, TSLF, PDCF, AMLF

MMIFF, BTFP (no different than playing the 0% credit card roll game), MSLP, PMCCF, SMCCF, MLF

TGA drains or expands, SLR waivers appear, SDRs spike

Each acronym represents a one-time access point to otherwise unusable liquidity—a vault key. That is likely what Treasury Secretary Scott Bessent meant when saying, “Monetary policy is a jewel box—it must be preserved.”

Why Stablecoins Matter: The Velocity Dilemma and Rise of a New Monetary Architecture

The only way the current financial system works is through monetary velocity. Money needs to move. In Keynesian thought, velocity is viewed as inherently good. But that’s only half the truth.

⚖️ Velocity Is a Tool, Not a Virtue

Too little velocity and the system grinds to a halt: credit stalls, growth flatlines, and recession risk surges.

Too much velocity, and the system overheats—bubbles inflate, asset prices disconnect, and crashes become inevitable.

Modern Monetary Theory (MMT - 2020s) showed us what happens when you push velocity without restraint: inflation, inequality, asset bubbles, and ultimately a credibility crisis.

On the other hand, pure Austrian economics, in its refusal to engage in credit or liquidity expansion, risks stifling productive innovation and creating deflationary spirals.

Credit and liquidity are essential. But when debt-fueled velocity runs unchecked, it becomes poison; see Weimar Germany. That’s the end game if we don’t change course.

🛠️ The Old Fix: Create New On-Ramps

Our old “on-ramps” were slow, opaque, and ultimately inefficient. They were good enough for the 20th century. Not the 21st. Bitcoin and Stablecoins are the new on-ramps suited for the 21st Century and beyond. A story similar to 1913, Central Banks and fiat money.

Bitcoin = Digital Gold 2.0

Offers digital stability and credibility outside the nation-state.

Can serve as the anchor for a new monetary regime in the way gold once backed Bretton Woods. Bretton Woods 2.0?

Solves what SDRs never could: a neutral, programmable, permissionless store of value with no central issuer.

Stablecoins = Programmable Liquidity Infrastructure

Deliver real-time, frictionless settlement far faster than fiat.

Provide instant liquidity and are tailor-made for velocity-driven financial systems.

Unlike Eurodollars:

Leverage is visible, not opaque.

Usage is trackable, down to IP addresses, wallets, and on-chain flows.

Think of it like an internet packet trace tool, but for digital dollars—monetary surveillance with velocity.

With stablecoins, central banks and market participants can see who’s borrowing, where credit is flowing, and which sectors are overheating. All in real-time. Not necessarily a good thing, in the wrong hands, but the path of least resistance nonetheless.

🗺️ Consolidation: Toward a New Global Monetary Framework

If 180+ fiat currencies have proven to be a fragmented, inflation-prone mess… why not consolidate the global system?

A future of ~50 regional players, anchored by 15–20 dominant stablecoins.

Pegged to real assets or rules-based systems.

Bitcoin at the center, like gold was under Bretton Woods.

Stablecoins as programmable currency, but more liquid, transparent, and interoperable.

🧭 It’s Bretton Woods + SDRs + crypto rails = A New Monetary Order

A conversation between

of TFTC and of Crossborder Capital highlights some significant shifts in asset classes as this all unfolds.31 - 35min mark: China lifting gold prices as a way to reach safety first by debasing against a sound money asset - Gold.

40-45 min mark: The importance of holding wealth in non-paper money assets to preserve purchasing power. Younger generations realized and did this in Weimar Germany’s 1920s hyperinflation episode. A generational wealth transfer from older generations not holding stocks to younger generations who bought stocks as a hedge. Michael proposes that could be Bitcoin today based on the similarities between younger and older generations’ opinions of the asset.

In history, US Investor portfolios have only been this defensive 3% of the time.

🧭 Conclusion: The Illusion of Liquidity

Liquidity today isn’t about how much exists—it's about who can access it, how fast, and under what conditions. We’ve built a high-leverage, collateral-based system that functions only under tight tolerances.

When it breaks, we don’t “print money”—we engineer pathways to move already-trapped liquidity into action. And every time, the plumbing gets more complex, and the real economy gets less responsive. Marty Bent and Parker Lewis recently connected a few pieces of this puzzle together when when revisiting Triffin’s Dilemma. Interestingly, it’s a similar synopsis as to one I covered in 2022 in a Bitcoin Magazine article.

In a world drowning in trapped liquidity, velocity without transparency is chaos.

Stablecoins fix that.

Bitcoin anchors it.

And maybe—just maybe—this is how the global system reboots?

Interesting perspective. Linking it today @https://nothingnewunderthesun2016.com/